Election Outcome Presents Opportunity For Investors

As the November 2024 election draws near, the election outcome will profoundly affect the financial markets. Whether Donald Trump or Kamala Harris wins the presidency, each administration will bring distinct policies creating investment opportunities and potential risks for investors. With a divisive political landscape, it is crucial to understand how these potential outcomes can shape the stock market and your portfolio strategy.

Let’s break down the key sectors that stand to gain from a Trump or Harris presidency and explore the risks investors should be aware of heading into this election outcome.

Investment Opportunities in a Trump Presidency

Energy & Fossil Fuels

If Trump wins, that election outcome will likely favor the traditional energy sector, with policies designed to roll back regulations from the current Administration that have restricted oil and gas exploration. During Trump’s previous term, he aggressively pursued pro-energy policies, resulting in a boom for fossil fuel companies like ExxonMobil (XOM) and Chevron (CVX). As shown in the chart below from the U.S. Energy Information Administration, crude oil exports surged from 1 million barrels per day in 2017 to 3.5 million in 2020. During a second term, Trump’s emphasis on deregulation and energy independence could lead to a similar boost.

Investors should look for growth opportunities in large oil producers and service companies like Diamondback Energy (FANG), which directly benefit from increased production.

Defense and Aerospace

Defense spending is another area that would benefit from a Trump election outcome. Trump has been a strong proponent of increasing military spending to modernize and strengthen national security. Such policies historically benefited defense contractors such as Lockheed Martin (LMT) and Raytheon Technologies (RTX). These companies will likely see further government contracts and funding for military expansion, making them attractive investments. Given that defense spending increases in Democratic and Republican administrations, such will likely be the case again. Lastly, defense stocks are also typically defensive in uncertain market environments and are generally very stable dividend payers.

Financials and Banking

A Trump election outcome is also expected to favor the financial sector through further deregulation. Trump has already demonstrated a willingness to roll back restrictions imposed by Dodd-Frank, making it easier for financial institutions to operate with less oversight. This would benefit large banks such as JPMorgan Chase (JPM) and Goldman Sachs (GS). However, larger regional banks like Truist Financial (TFC) and PNC Bank (PNC), which have struggled amid higher interest rates during the previous administration, would also benefit.

A stronger economy, reduced regulatory restrictions, and lower interest rates from the Federal Reserve would create higher profitability, reduced compliance costs, and less collateral impairment. Additionally, as discussed in “Tax Cuts And TCJA,” Trump’s policies may favor continued corporate tax cuts, boosting bank earnings and shareholder returns.

Investment Opportunities in a Harris Presidency

While Kamala is not the incumbent, she represents a likely continuation of the current administration’s policies.

Clean Energy and Sustainability

If Kamala Harris wins the election, it will likely create a tailwind for the clean energy sector. Following the Inflation Reduction Act, which allocated more than $800 billion to climate change-related projects, Harris will likely promote policies to increase investment in renewable energy sources. Companies involved in solar, wind, and energy storage, such as NextEra Energy (NEE), First Solar (FSLR), and Tesla (TSLA), would stand to benefit. However, it is notable that more than 100 solar-related companies have filed for bankruptcy in 2024, so investors must remain prudent about individual company fundamentals. Investors could consider clean energy ETFs, such as ICLN (iShares Global Clean Energy ETF), to gain exposure to a broad range of companies that could benefit from government subsidies, tax incentives, and infrastructure projects focused on sustainability.

Healthcare and Pharmaceuticals

Harris’s healthcare agenda is expected to focus on expanding access to healthcare, strengthening the Affordable Care Act, and implementing policies to reduce prescription drug prices. This could benefit both large pharmaceutical companies like Pfizer (PFE) and Johnson & Johnson (JNJ), as well as healthcare providers and insurers like UnitedHealth Group (UNH).

Additionally, with an increased focus on public health, biotech companies involved in innovative medical research and vaccine development could also experience growth. Investors should watch stocks related to healthcare services and medical device innovation.

Technology and Innovation

Harris has consistently supported advancing technology and innovation, particularly in artificial intelligence (AI), cybersecurity, and 5G infrastructure. Companies like NVIDIA (NVDA), Microsoft (MSFT), and Alphabet (GOOGL) are well-positioned to benefit from increased government support for technological infrastructure and research. With a Harris election outcome, investors can expect further investments in tech sectors that improve digital access and data privacy protections. This may also boost demand for cybersecurity solutions, benefiting companies specializing in this area. For further analysis, read our report on the coming demand for electricity needed by artificial intelligence.

Conclusion: Risks and How to Mitigate Them

Regardless of who wins, the election outcome presents certain risks that investors must consider. Election years often bring increased volatility, and this cycle is no exception. Here are the key risks and strategies to manage them:

- Tax Policy Uncertainty: A Harris presidency could bring corporate tax hikes, which may negatively impact the profitability of tech and financial companies. In contrast, a Trump presidency may lower taxes but could lead to growing deficits and potential inflationary pressures. Investors should stay informed of potential tax changes and consider shifting some assets to tax-advantaged accounts or dividend-paying stocks to cushion against negative impacts.

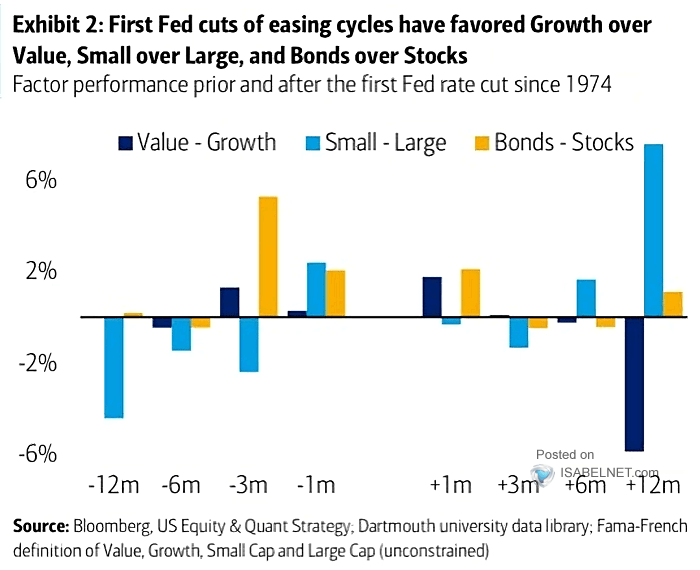

- Interest Rate and Inflation Risks: Both administrations will face challenges managing inflation and interest rates. As the Federal Reserve cuts rates, there is a risk of a resurgence of inflation. Investors should consider diversifying into sectors less sensitive to rate changes and focus on fundamentals and dividend payout histories.

- Healthcare Sector Volatility: A Harris administration may introduce new healthcare regulations that could compress margins for some pharmaceutical companies. While expanded healthcare access could benefit healthcare service providers, introducing pricing controls could create downside risks for drug manufacturers. Investors should maintain a diversified exposure to the healthcare sector, balancing risk with potential gains from policy-driven expansion.

How to Protect Your Portfolio

- Diversification: Spreading investments across sectors that could perform well under either administration—like clean energy, defense, and healthcare—can help mitigate risks tied to the election outcome. Maintaining a balance between growth stocks and defensive sectors can help weather volatility.

- Dividend-Paying Stocks: Companies with strong dividend histories, like Procter & Gamble (PG) and Coca-Cola (KO), can provide income during market uncertainty and reduce portfolio volatility.

- Follow Your Risk Management Discipline: As we often discuss, a healthy regime of taking profits, rebalancing portfolios, moving up stop-loss levels, and increasing cash balances can help mitigate portfolio risk during periods of uncertainty.

I have no idea how the election will turn out in November. However, like every election outcome, investors will have opportunities and face risks. Whether it’s Trump’s pro-energy and defense stance or Harris’s focus on clean energy and healthcare, positioning your portfolio for the post-election market requires careful consideration. Staying diversified, preparing for volatility, and managing risks will be key to navigating whatever outcome lies ahead.

Disclosure: RIA Advisors has positions in most or all of the specific stocks and ETFs mentioned in this article for its clients. This discussion is not a recommendation to buy or sell anything, and RIA Advisors may or may not own some of these positions at the time of publication. In no way should any of the information in this informational blog be considered a recommendation, solicitation, or advertisement. This blog is for educational and informational purposes only; past performance does not guarantee future results.

The post Election Outcome Presents Opportunity For Investors appeared first on RIA.